Primary vs secondary market research: types, sources and examples

Jun 9th, 2021

Contents

What is primary research?

What is secondary research?

Examples of primary and secondary research

How to conduct market research to include both approaches

If you are going to start a new business or expand a product to a new market, you will usually need to conduct market research. Before you start, you can come across a number of questions: How to define your goal or goals? Where should you start? How do you know if you have enough information to consider the research completed?

The companies that conduct market research often receive a poor response, resulting in small sample size and unreliable predictions. It is difficult to categorize the respondents by dividing them into groups instead of defining all of them as “customers”. This creates the other problem — the organizations cannot understand their target audience or buyer personas. Sometimes the challenges arise from selecting the right metrics, lack of documented processes and workflows, lack of discipline or operational skills when conducting the market research.

Market research is essential for companies not only to learn about trends and consumer behavior. It is also beneficial to the organizations when making critical decisions, determining new opportunities, identifying the competitors, and improving the offerings. The main criterion of successful market research is the achievement of the business objectives. Key objectives might include growing the company’s reputation on the market, improving product performance, and gauging customer reactions to changes in price or new market developments.

What is primary research?

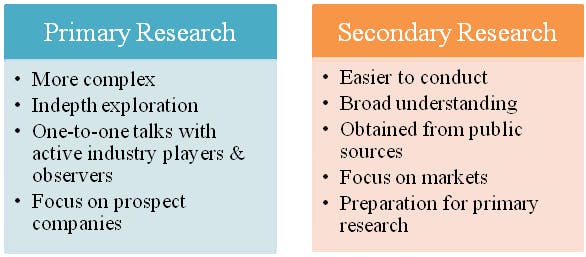

Primary market research is a methodology of determining the viability of the product or service based on data collected directly from the source — potential customers. Primary market research is done from scratch, rather than relying on the previously done research.

Сommon methods of conducting primary market research include in-person interviews, focus groups, surveys, product trials, product testing, or direct observations. Marketers usually conduct primary research to address a certain problem that requires in-depth analysis.

Types of primary research

There are two main types of primary market research: quantitative and qualitative. Both types of research are vital for obtaining different kinds of information.

- Quantitative market research deals with numerical data rather than consumers’ feelings, opinions, and attitudes. The process implies collecting large amounts of statistical points using surveys, polls, and questionnaires. The mathematical, statistical, and computational methods allow for gathering the data that researchers can further analyze to determine the patterns and averages, form predictions, and make generalizations. The purpose of quantitative market research is to determine the problem and understand its prevalence. Quantitative market research can provide a very accurate result that helps companies develop a clear picture of their objectives and how to reach them.

- Qualitative market research focuses on collecting behavioral, observational, and non-numerical data like audio, text, or video to gain insights into consumer opinions, motivations, or experiences. Qualitative market research involves open-ended questions and a small sample consisting of six to ten respondents and allows for an in-depth discussion of the topics. The primary methods used for conducting qualitative market research include focus groups and interviews.

Sources of primary research

Primary research sources are in-depth interviews, surveys, focus groups, social media monitoring, and questionnaires. Let’s discuss them in detail below:

- In-depth interviews are great for understanding how the customer group perceives a brand or product. In-depth interviews are interactive and usually have a flexible structure. These interviews are conducted by a trusted moderator who considers not just the respondent’s answers but also body language and general impression.

- Surveys help collect a large amount of information about the population’s characteristics and preferences. In the future, marketers can use this data to predict consumers’ behavior.

- Focus groups are the interviews of selected participants involving the representatives of the target audience. The group participants are selected according to specific criteria, such as location, age, socioeconomic status, etc.

- Questionnaires are research tool that includes a series of closed-ended or open-ended questions to obtain feedback from your customers. There are different types of questionnaires, such as computer, telephone, mail questionnaires.

- Hypothesis testing for existing products through A/B testing or multivariate testing allows for examining the price for different markets or different audiences, comparing web page design and conversion effectiveness, etc. Both methods have similar core mechanisms; however, multivariate testing compares a more significant number of variables and provides more information.

- MVP testing for new products is based on releasing a version of the product with a small number of first-priority features needed for early customers. Later, the customers can provide valuable feedback to improve the future versions of the product.

- Targeted social media monitoring helps determine the information about your company, your industry, and your competitors. This information involves all mentions of your brand, such as reviews, product questions, or service repair complaints.

Primary research allows for collecting data that has not been previously gathered, provides specific results that address the issues relevant for your company, and delivers up-to-date information. The other benefit of primary market research is the uniqueness of the data that competitors would not be able to access. Thus, you receive a competitive advantage. Due to the approaches of this method, you can research a small sample and then apply the results to the entire market. On the other hand, primary market research is often expensive, time-consuming, and requires face-to-face contact with customers.

What is secondary research?

Secondary market research is a kind of market research that relies on using data from secondary sources, which was not previously prepared specifically for the goals of current research. In other words, in secondary research, marketers gather and analyze the previously collected data to serve a purpose other than the purpose of their research. The secondary information is often acquired from industry and trade associations, government agencies, media agencies, industry-focused newsletters, magazines, and newspapers. This type of research is usually more cost-effective and accessible than primary market research.

Types of secondary research

There are two types of secondary market research: secondary market research from internal sources and secondary market research from external sources.

- Internal data. Internal data can be found in the databases of the company and used for future reference purposes. A company’s internal data includes customer account information, product usage data, sales records, or previously prepared research reports. There are also records of previous advertising and marketing campaigns, departmental records, etc.

- External data. External data is initially prepared by people outside the current company environment, such as data from competitors, journals and magazines, industry surveys, and market reports.

Sources of secondary research

As well as with primary research, secondary research may also use lots of different sources of information. Below are some of the most widely used.

- Sales data is a valuable source of information for secondary market research. Every company collects data concerning everyday operations, delivered orders, invoices, and returned goods. This information is handy for marketers because it allows gathering insights into sales by territory, customer type, average sales by salesperson, prices, discounts, and other data.

- Financial data allows for estimating the efficiency of marketing operations. It includes the production costs, storing, transportation, and marketing costs. It can also supply insights into which products or services bring you more significant profits or drive your business into the red.

- Governmental and local statistical data. Many governmental, regional and municipal organizations collect data that businesses and non-profits can use for market research purposes. This information includes demographic data, economic data, trade statistics, and production statistics. For example, you can find volumes of US-focused data on data.gov, while for European Union statistics, you can explore the official site of Eurostat.

- Trade associations often provide free and paid reports to inform professionals about the situation in the economic sector.

- Specialized journals and media regularly publish news, research, press releases, and professional articles, which can be excellent sources of up-to-date secondary data.

- Commercial marketing research data is collected by specialized research organizations that resell it to other companies. The data gathered by these companies concerns the consumer population, attitudes, trends and behaviors, online and offline purchases.

- Search engine results are a good source of free and commercially available data.

- Competitor research. You can acquire information about competitors from different sources, such as their websites, review sites, and media publications. This approach enables you to develop a profound understanding of how market participants and clients perceive a particular company.

Secondary market research is a perfect basis for primary research as it helps determine and predict the latter’s effectiveness and suitability. The information from government sources, libraries, and media is reliable, extensive, and covers many issues. The other advantages of secondary market research are low cost, time-effectiveness, and the opportunity to obtain a broad spectrum of free data in a shorter time than primary research.

The disadvantages of secondary market research are the lack of quality and accuracy of data collected by a third party. The information provided by secondary research is not specific and not always recent enough. Besides, the data is available for many companies, so it deprives your company of a competitive advantage.

Examples of primary and secondary research

Market research will help you reduce the risk of making business decisions and determine the pitfalls before launching the new product. We will provide several examples to demonstrate how companies can use market research to identify and solve business challenges in practice.

Starbucks

The world-famous coffee company conducts market research in many ways, including primary research methods, such as consumer feedback, in-store product testing, and social media monitoring. In 2008, Starbucks even created a specialized platform, My Starbucks Idea, where the customers can provide their ideas about new offerings or changes to the existing products.

The corporation also applies the social media monitoring method and collects feedback from different platforms, including Facebook, Twitter, Instagram, and Reddit, to improve the products. Starbucks tests the new ideas in selected stores to understand the feasibility of making some changes before the official launch.

The company applies secondary market research methods to shape the new product lines. Starbucks gathers data from the market research companies and analyzes the data from the stores. Due to the feedback on My Starbucks Idea and combined market research, Starbucks successfully launched dairy-free milk alternatives in European and US stores.

Primary research methods: consumer feedback, in-store product testing, social media monitoring.

Secondary research methods: social media monitoring, competitor monitoring, existing data from market research providers.

Ecommerce market research into new product launch

If you are going to launch an e-commerce platform or introduce a new product to the existing store, conducting market research may bring the needed transparency into this business decision prior to moving forward with it. Firstly, it is vital to determine the market size for the business or the product. Then you will need several pieces of information concerning statistics and trends in your industry, consumer behavior, and current demand for your product.

To discover information about the industry size, trends, and growth rates, you can apply secondary market research methods and dig into the industry articles and search for information from marketing companies about the things people tend to buy online. The other helpful source will be market research reports.

The further step is to understand the needs of your potential customers, their socioeconomic and geographic conditions. The perfect way to get this information is to perform primary research and conduct customer surveys. You can start with specialized forums, Facebook groups, or other social media channels.

For example, if you are launching an online clothing store, you can conduct the online survey using Google Forms, Google Surveys or TypeForm and target specific customer segments. You can include questions about age, location, income, favorite brands, and stores where these people typically buy clothes.

You can also use the form to inquire if some of the surveyed customers would be willing to participate in in-depth interviews. For in-depth interviews, prepare a list of open-ended questions, which can facilitate your discussion with each interviewee.

Primary research methods: customer surveys, questionnaires, in-depth interviews.

Secondary research methods: industry articles, competitor research, market research reports.

SaaS market research for new solution launch

Before the new SaaS product launch, you need to conduct market research and analysis to understand the competition and customer preferences and dislikes. First, you can make a list of existing players in the segment. You can monitor social media for mentions of each competitor to understand what their clients are saying about the solution, product features, and functionality, customer service to find opportunities, which a new product can explore on the market. In addition to social media, you can use specialized review platforms, such as Capterra or TrustRadius.

As the next step in analyzing your competitors, you can gather data about their online performance. With Ahrefs, you can get information on how your competitors rank on Google. SimilarWeb allows you to analyze your competitors’ websites and see engagement rate, traffic ranking, keyword ranking, and other audience metrics. Besides, you can conduct secondary market research and find research on businesses in your industry with the help of Google Scholar.

You can expand your market research by finding information about your potential customers. Continuing with the methods of secondary research, you can gather data about your target audience’s behavior. With the help of a business account on Facebook, you can collect information about the demographics, including gender, age, location, activity, purchases, and design customer personas.

If you’re building a unique product in the segment with low competition, you can explore Product Hunt to see if anyone has recently created similar products. Product hunt can show you if similar products have received positive feedback or ideas for improvement on top of how you envision your future solution.

As the final stage of your exploration, you can start developing the basics of your future solution to attract your potential audience. The simplest way to do it is by making a landing page, which describes your future product and allows visitors to subscribe to future releases and updates. This is how Dropbox started back in 2007. If this option is not sufficient for you, you can develop an MVP to provide users with initial functionality to test if they will be interested in signing up. Of course, this approach would give you the most significant volume of feedback, although it’s the most expensive one to undertake.

Primary research methods: product landing page, minimum viable product, Product Hunt launch.

Secondary research methods: social media monitoring, specialized industry-focused websites, social media analytics tools.

How to conduct market research to include both approaches

You can perform market research at any stage of your business life cycle, starting from pre-launch. Primary market research allows for evaluating the competition within the market, understanding the competitors’ quality of service, and discovering their communication channels. With the help of secondary market research, you can analyze the existing surveys and studies concerning your industry, read newspaper reports, explore company reports data and government data. The overall market research usually consists of the following steps:

Step 1. Define the goals of the research

The first stage of comprehensive market research is to define the central problem and research objectives. You will also need to define the purpose of the study, what information is required, and find relevant background data. This step includes interviews with industry experts and discussions with the decision-makers.

Step 2. Secondary research

At the second stage, you need to conduct secondary research and analyze all the secondary data sources on the target segment. The goal of this step is to compare the information and create a high-level overview.

Step 3. Primary research

Once you have completed the secondary research and collected the available information, you can move to primary research. You need to start from the most cost-efficient methods of primary research that include paper questionnaires, online surveys, phone interviews, and face-to-face interviews.

Social media is an excellent source for primary research. You have the opportunity to analyze the large amounts of data provided by different people on a variety of platforms. You can save money by selecting the students as focus groups or target audiences.

Step 4. The concluding stage of research

If you meet the research objectives by completing the previous steps, you can finalize the market research. In some cases, secondary research may already provide you enough information to complete the research. Other times, there is a lack of data in secondary sources, so you will have to conduct primary research.

Once you feel like you have gathered enough data to answer the initial research question, prepare a report, which will provide a summary of findings. Even if you’re doing it for your own purposes, putting it in writing helps build a comprehensive overview of the findings and research results. You can sometimes find out that you have new questions at this stage, which need to be researched using the same methodology. Or, hopefully, you’ve been able to answer all your questions - now comes the time to act on it!