Angel investors: what they are and where to find them?

Dec 21st, 2022

Contents

What are angel investors?

How do angel investors work?

How to find angel investors?

Top websites for finding angel investors

Angel investing implies more than providing funds to startups. Unlike venture capitalists, business angels often take an active part in developing startups they fund. Moreover, many analysts believe that angel investments are one of the major forces influencing the launch and expansion of new firms. According to a Harvard report by William R. Kerr, Josh Lerner, and Antoinette Schoar, startups with angel funding have a higher chance of success than businesses with other types of the initial investment. The paper says that angel funding is associated with faster growth as assessed through increased website traffic, a larger volume of outside fundraising, and higher survival rates.

In this article, we will provide an overview of angel investing, compare this type of financing with other options, describe how angel investors work, and give tips on how to find angel investors for your startup or small business.

What are angel investors?

Angel investors or business angels are people who provide funding to small businesses and entrepreneurs in return for a stake in the company. Angels often fund startups when most capitalists are unwilling to provide funding due to the high risk of failure at the early stages. In frequent cases, angel investors are entrepreneurs’ relatives and friends. The money provided by angel investors may be a one-time help or recurring funding to support a company and help overcome the challenging initial stages.

In contrast to venture capitalists who manage the pool of other people’s money through funds, angels often invest their own capital. We will go into more detail about venture capitalists in the following paragraphs. Even though the investment often reflects the individual’s decision, the entity that delivers funding may be an LLC, an enterprise, a trust, an investment fund, or another organization. Some angels invest through angel groups or equity crowdfunding to share funds and provide advice to companies in their portfolios. In addition, these investments typically comprise less than 10% of the angel’s portfolio.

Most angels seek investments that require a higher rate of return than traditional investment methods. As many angel investments bear high risks and can be lost at the early stage, angels are looking for investments with the potential to return ten or more times the amount within five years. This can be done through an exit strategy that implies acquisition or initial public offering. In some cases, angel investors are looking for startups with the potential to bring a return 20-30 times the initial investment.

Angel investors are often former business owners or executives interested in funding startups not only because of financial gain. They want to keep up with recent developments in a certain industry, coach the next generation of business leaders, and use their networks and knowledge on a part-time basis. Besides funding, angels provide feedback and valuable contacts. Since their securities are not listed on public exchanges, companies find investors through recommendations from trusted sources and business contacts, at symposia and conferences hosted by angel groups where startups present their ideas to investors.

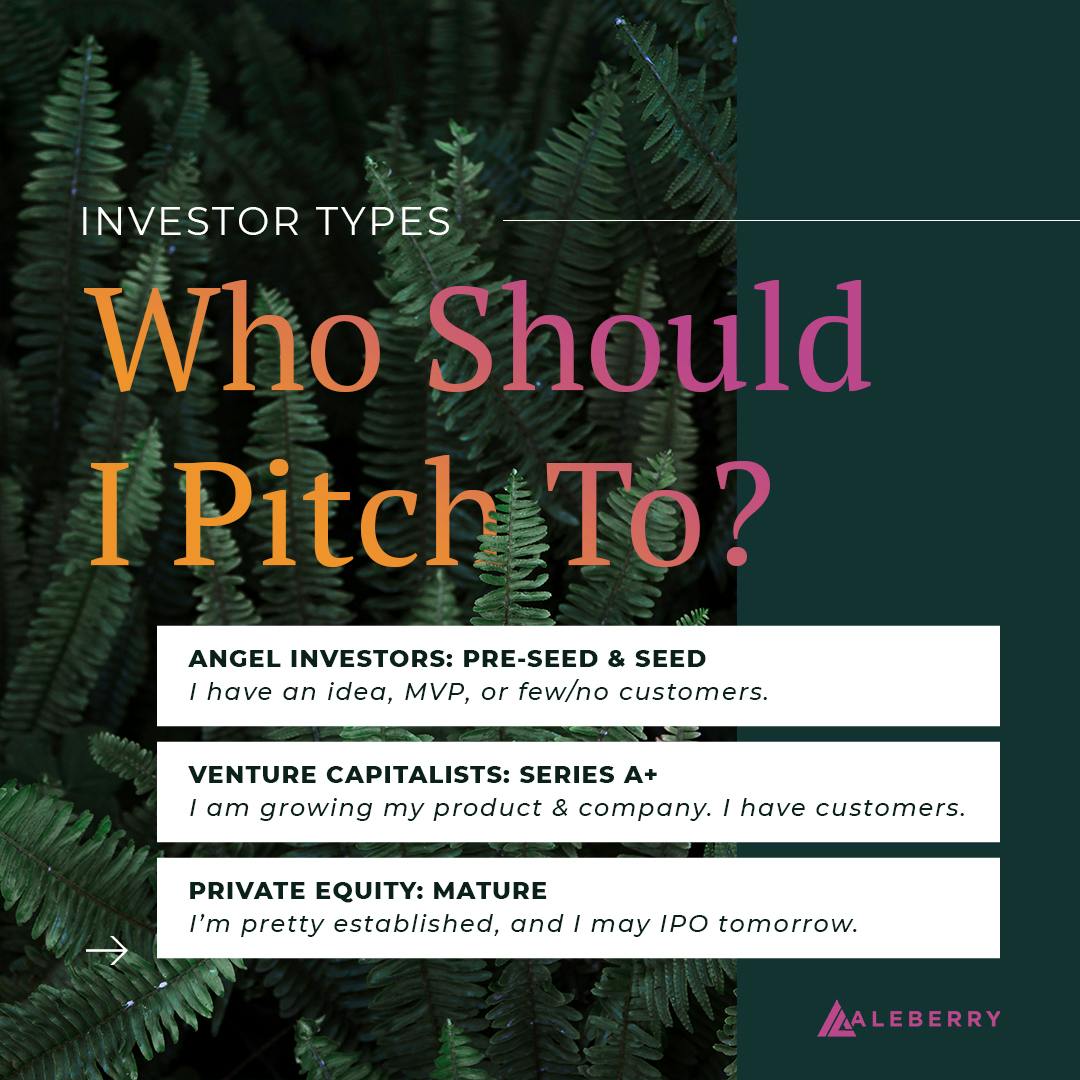

To determine which financing method will be the best choice for your company, we will describe other types of early-stage investments: venture capitalists and private equity. Now let us discuss the difference between angels and venture capitalists.

Angel investors vs venture capitalists

Venture capitalists are people or organizations that fund risky startups. The business’s potential for rapid growth often exceeds the possibility of failure, encouraging venture capitalists to provide finance. After a predetermined period, an investor may exit the investment by selling their ownership stake to another investor or on a public market if the company has gone through an IPO by that time.

Like angel investors, venture capitalists pose a low risk to business owners as they do not demand payback if a business goes bankrupt. In addition, venture capitalists have the appropriate background and a wide range of contacts, including other investors and enterprise managers. The other similarity between angels and venture capitalists is their interest in tech startups and support for innovative businesses.

Let us now discuss the differences. While angels often work independently and invest their own capital, venture capitalists are a group of experienced investors who get their funding from individuals, businesses, and other organizations. The other difference is the amount of funding. Business angels commonly invest between $10,000 and $100,000. If they work together, angel investors can collectively provide more than $750,000. Venture capitalists, in contrast, typically invest more significant amounts, the median VC deal size being around $14 million, according to Statista. In addition, angels invest in seed startups, while venture capitalists may fund both developing and early-stage companies.

The primary responsibility of business angels is to give funding. Although they can provide the information and crucial connections, it is not their duty. Their level of engagement is defined by the startup's requirements and the angel's personal preferences. At the same time, venture capitalists’ role is to help create a profitable business. Thus, they take part in hiring a company’s senior executives, determining its strategy, and giving advice. Additionally, while venture capitalists are required to act in their partners' best interests, they spend more than $50,000 researching potential investment prospects, compared to nearly no due diligence for angel investors.

In the following paragraphs, we will compare angel investors to private equity and consider the resemblances and differences between these types of investors.

Angel investors vs private equity

Private equity refers to investment firms that acquire and manage businesses before selling them. They sell a company or its shares to make a profit after reorganizing the business and improving its performance. Private equity firms invest in a wide range of industries, including healthcare, retail, technology, real estate, and financial services.

PE firms invest in developing private companies using money acquired from limited partners, such as individual investors, institutional investors, and pension funds. Firms create private equity funds by using a pool of capital raised from partners. When the investors achieve their fundraising goal, they close the fund and invest money in promising companies. As a result, they can invest in stagnant businesses that experience financial difficulties but still have growth potential.

Although both private equity firms and business angels deal with risk and expect high returns on their investments, there are some considerable differences. While angel investors are interested in early-stage companies with innovative products, private equity firms choose mature businesses in distress to purchase, restructure and sell them. Business angels invest sums starting from $10,000 for a minority stake, and they commonly conduct their investments in companies before they have their first clients. PE firms, on the contrary, invest millions or even billions of dollars and take a majority stake in an existing business, typically combining debt and equity sources of capital. Angel investing is riskier than private equity investing as angels often lose their investment if a startup fails, while private equity firms get, on average, an 11% annual return.

Once you have considered the main difference between the three types of investments, we will dive into how angel investors work in five steps.

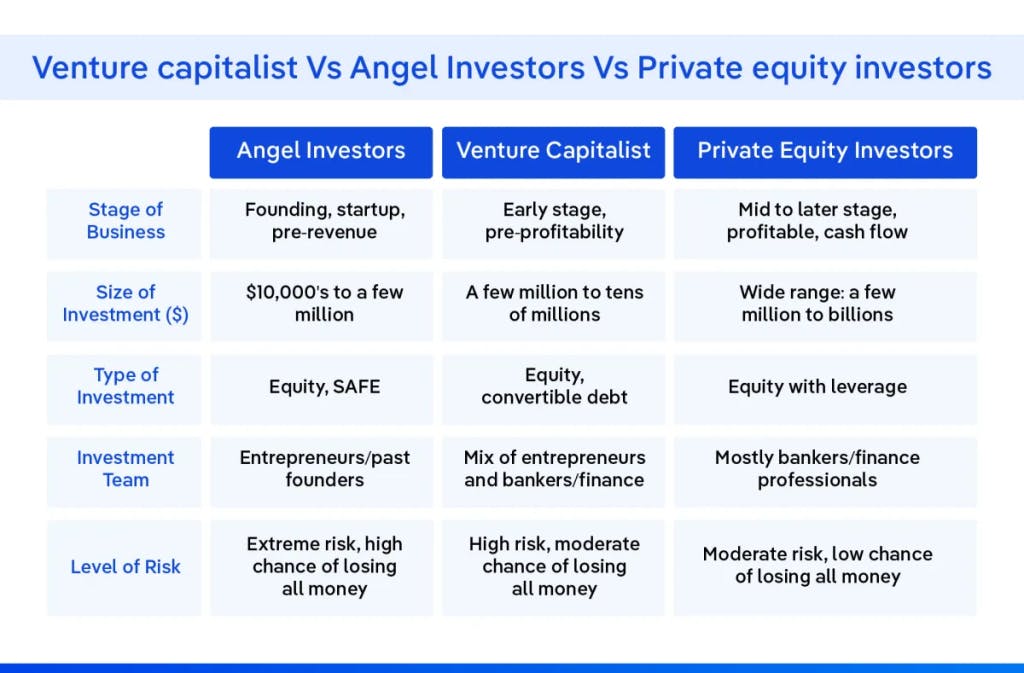

How do angel investors work?

Angel investors don't have a predetermined sum to invest in a startup company. It can vary from a few thousand dollars to a few million dollars. They typically prefer companies related to healthcare, electronics, utilities, and telecommunications. In addition, angel investors usually hold no more than 25% of a company. Let us describe the steps of the angel investment process in greater detail.

Step 1. Business angels identify investment opportunities

Before investing, business angels should develop a positive reputation, join angel groups and establish themselves as successful investors among startup founders. Angels can find startups and growing companies through networking, recommendations from professional investment organizations, online business forums, industry seminars, or local events.

Angel investors prefer to get involved during a company’s seed or fundraising stage. Business angels come into play when the company is an idea or after the initial round of investment which often comes from the founders’ funds, bank finance, or entrepreneurs’ friends and family. Business owners use initial startup funding to launch the product, but more is needed for the following stages. Angel investors provide capital after the initial funding but before a startup gets noticed by venture capitalists.

Step 2. Screening process

At this stage, angel investors analyze companies to determine which businesses they want to collaborate with and which ones they do not. One of the essential criteria is higher return rates that comprise 22-27% compared to the returns from traditional investments.

If both parties are interested in investment, a business angel speaks with the company’s founders, reviews the company’s documentation, and evaluates the industry. Notably, some angel investors focus on a specific sector, such as software or healthcare, so they are not a good fit for companies specializing in other fields. Furthermore, angel investors have different levels of involvement in startup development. For example, some are interested in mentorship, while others prefer a more hands-off approach.

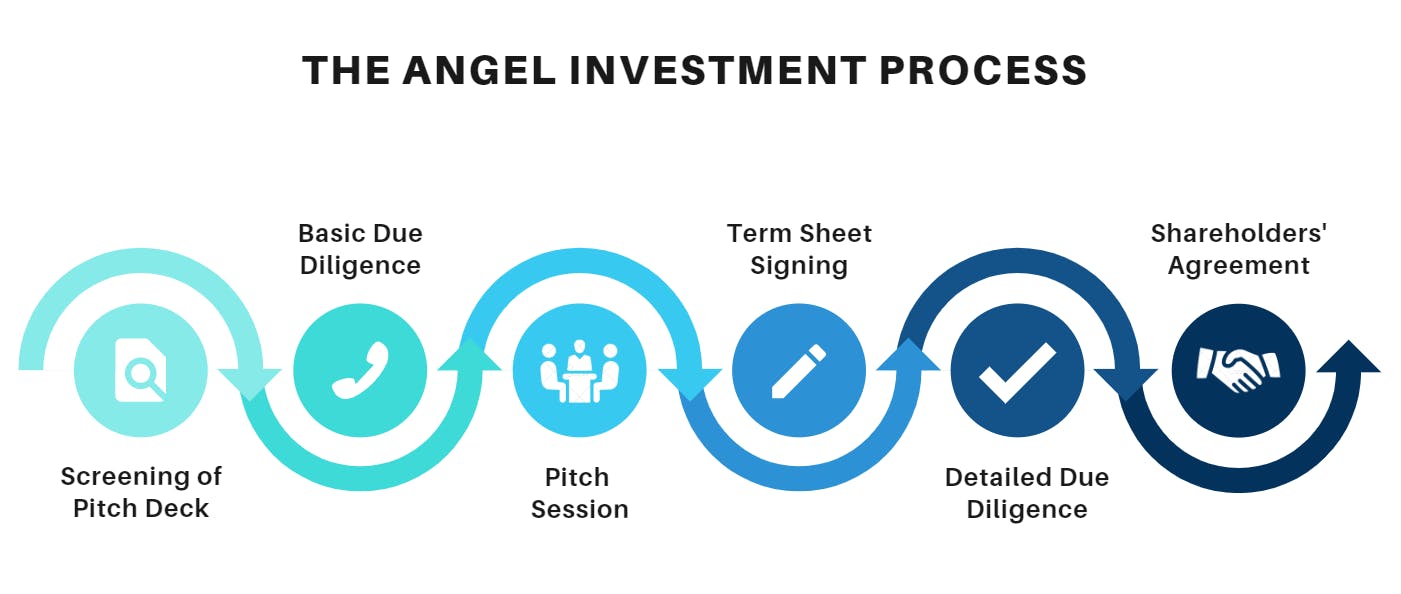

Step 3. Founders pitch potential investors

Most angel investors want to thoroughly analyze the team and company’s background before investing. Therefore, startup founders prepare a short presentation that provides a brief overview of their company and describes their financial needs and long-term objectives. A pitch can be delivered in any form, like an office presentation or an informal lunch meeting.

After the pitch, investors usually gather to discuss the presentation and clarify the necessary information. They consider potential difficulties, assess the company’s strategy, and ask follow-up questions. In some cases, network groups create a due diligence report that contains a checklist of problems they want to fix.

Step 4. Negotiating the terms

Investors who find the pitch interesting connect with startup founders and offer a deal. At the negotiation stage, they discuss the deal structure, investor’s rights, criteria for control and governance, the company’s exit strategy, and equity stake. After a verbal agreement between the parties, they set out the conditions in a term sheet, a non-binding agreement that outlines the terms of the deal.

It is critical to determine what additional funds the company may need while the conditions are being worked out. The common practice in the investing procedure is called deal syndication when the lead investor and founder collaborate to attract other investors as soon as possible. It is too expensive to renegotiate the deal at each stage of the investment process, so there should be alignment between investors and the executive team.

Step 5. Closing the deal

Before any money can be transferred, lawyers must prepare final legal documents in anticipation of the closing. Depending on the size of the deal, legal counsel can provide deal documentation within one to two weeks. Once the deal is officially closed, the company can start using the investment funds when the contract and legal agreement are signed. When this stage is completed, angel investors can start providing mentoring, contacts, and advice.

Further, we will discuss the process for finding an angel investor for the startup.

How to find angel investors?

Finding angel investors who believe in your business and strive to help may seem challenging, especially if this is your first try. Here are some great ways to find an angel investor interested in your startup.

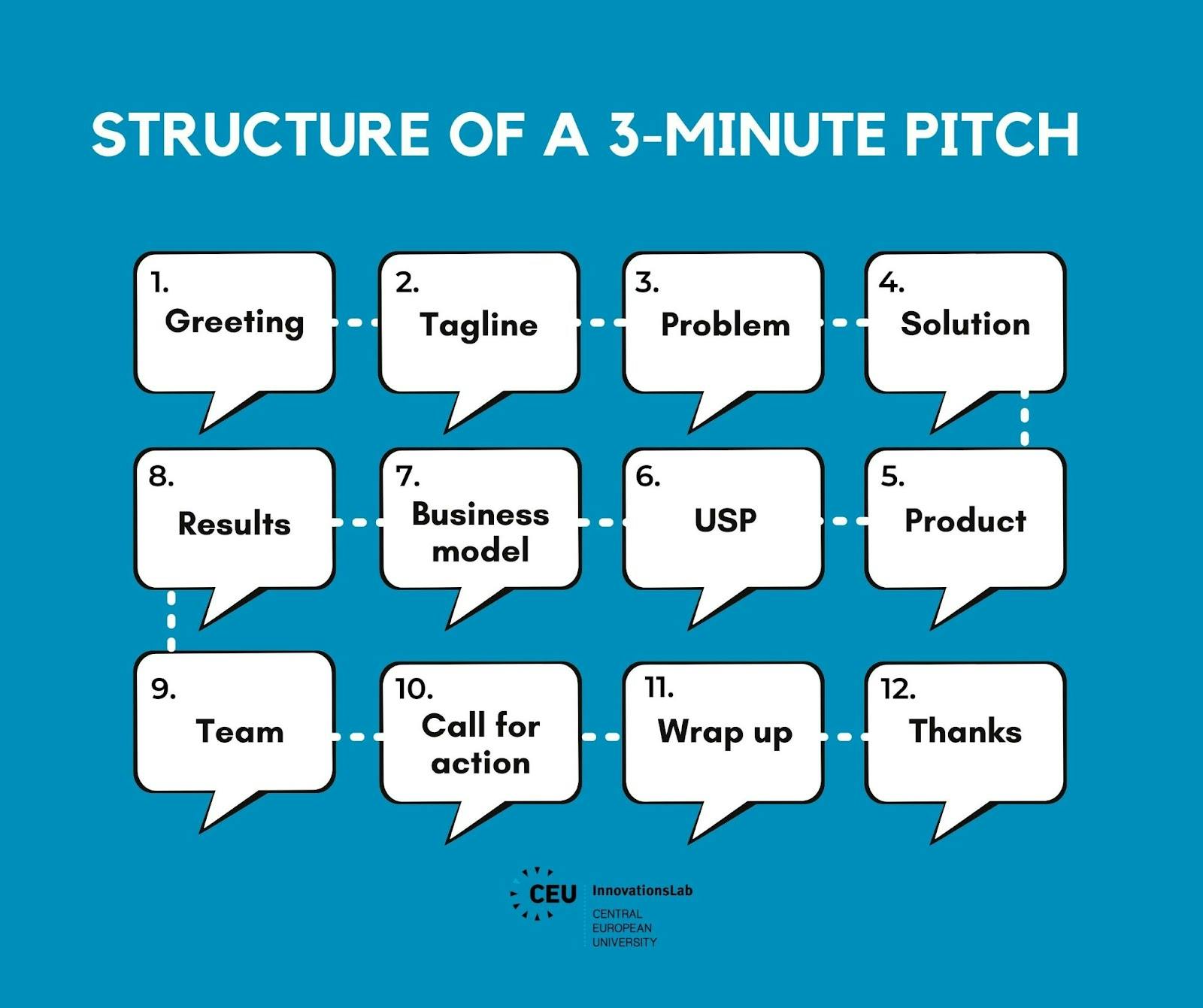

Prepare a pitch deck

Make a presentation with an elevator pitch and financial forecasts and describe the growth potential, engage a marketing consultant to help you better present the existing market opportunity. It is essential to involve advisors and experts that add credibility to your company. You can hire them as mentors or offer them equity in a business. It will make your company look professional in the eyes of investors and increase your chances of receiving funding. In addition, consult a lawyer to consider the terms of investment, such as the amount of funding you need, the time frame, the equity stake the investor will take, and the decision-makers.

Use your personal network

You can turn to friends and family for help. It is one of the quickest and simplest methods for raising money for your business. Your friends and family are already familiar with your startup, so they are more likely to provide funding at the early stage. Reach out to them to determine their interest in your product, learn what they know about angel investments and ask them to recommend you and your company. When raising money for a company, having a friendly relationship is always advantageous because most people are willing to invest in companies they have already heard about.

Meet with business owners

If you are going to target a niche market, you can get in touch with other company leaders in your industry via LinkedIn. Compared to venture capitalists, approaching angel investors is far more personal. First, check if you have mutual contacts with the angels on social media and ask them to introduce you to the business owner. Next, briefly describe your company and let them know that you've been watching their work and think their knowledge is just what you need. Then you can invite them to an informal meeting and discuss your startup.

Check angel networks and groups

Angel networks are popular ways to find investors for your business. These organizations accept pitches from entrepreneurs and exchange knowledge. Start with the networks and groups in your local neighborhood. You can also attend angel events across the country to find people interested in your business.

When approaching an angel investment group or network, try to stand out from the crowd and originally present your ideas. As angel investors receive many emails, proposals, and pitches, you need to draw their attention to your startup from the first moment.

The other useful method to find angel investors is to visit specialized websites. Let us consider the most popular ones below.

Top websites for finding angel investors

You might not even know where to begin if you do not already have a network of wealthy individuals or startup investors. So you can check these websites and reach out to potential investors.

AngelList

AngelList is a platform where businesses can partner with investors to raise money. The primary purpose of the website is to serve tech-oriented companies. To be included in the directory, you can create both a business profile and a personal account. This will help your startup increase visibility and let business angels find you.

Angel Forum

Angel Forum is an organization that links entrepreneurs and investors by creating a network to support angel funding rounds. With the website, you won't deal with any amateur investors because all users are professionals with a wealth of expertise. The website functions in the US and Canada.

Angel Investment Network

The Angel Investment Network, which works in the United States, aims to connect companies and business angels. The website provides you with access to a base of investors from all over the world. Once you've signed up, you can create a pitch on the website and publish it for investors. Then, they can find your presentation and get in touch with you.

Fundraising is a complicated process, especially at the beginning. You should speak to many investors and persuade them that your idea is worth the risk. Despite knowing it will be challenging, pursue your goals and never give up. After all, the journey of a thousand miles begins with the first step.