Barriers to entry: definition, types and examples

Jan 31st, 2022

Contents

What is a barrier to entry?

Sales volume

Capital availability

Financial risk and market uncertainty

Product differentiation

Cost advantage

Cost of capital

Economies of scale

Government regulation

Intellectual property and technological superiority

How to tackle barriers to entry?

Starting a business is not an easy task. Many startups have failed due to the barriers to entry or the obstacles preventing new companies from entering the market and favoring specific organizations or industries. Some businesses experience challenges that are easy to overcome; others face insurmountable obstacles.

Barriers to entry are the protective mechanism of the incumbent companies against the competitors. If the startups learn about entry barriers, the young companies will be able to avoid the problems related to entering the market with high barriers and understand how to protect themselves by building barriers to entry. We will review the most common obstacles, industries with high and low barriers to entry, some examples, and the ways to overcome typical barriers.

What is a barrier to entry?

A barrier to entry is the factor or obstacle that prevents an entrepreneur from launching a new business in a specific market. Joe S. Bain defines a barrier to entry as any condition that allows existing companies in a particular market to generate increased profits while preventing other firms from entering and competing. George Stigler provides an alternative definition. He claims that entry barriers are limited to the costs incurred by a potential market participant when entering the market, while the existing market players did not have to incur expenditures under the same conditions.

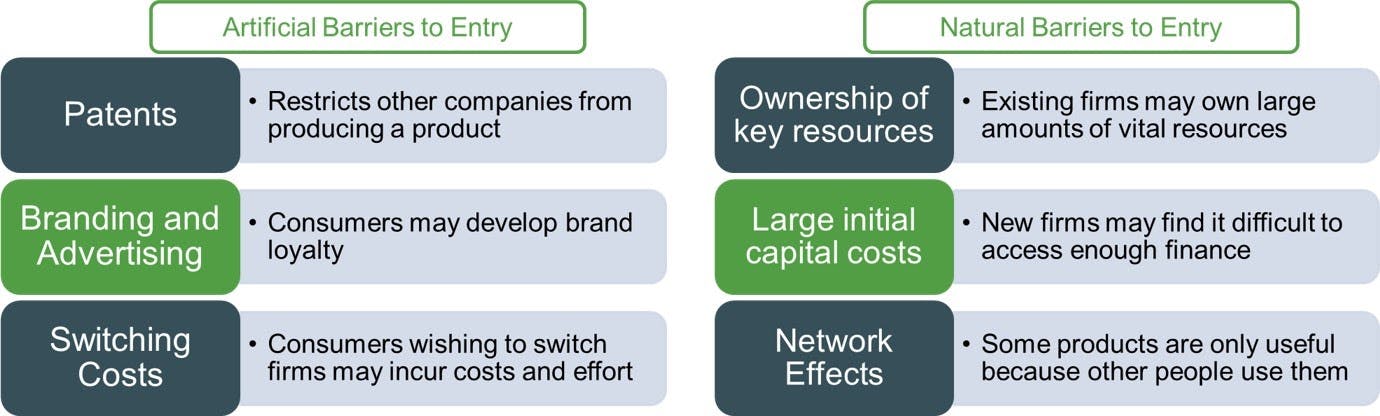

The barrier to entry may emerge spontaneously caused by market conditions or can be artificially created by existing competitors or the government. Natural barriers to entry often occur in a monopoly market where the cost of entry is prohibitively high for new businesses for various reasons. The possible causes may include lower operating costs for existing businesses than entry costs for young companies or the need to increase market share to function effectively. In addition, the buyers often prefer the established companies over the new entrants.

Artificial barriers to entry are usually created by other companies in the market or by the government. The firms can create difficulties for new entrants, such as intentionally decreasing prices to make it impossible to generate a profit. Artificial barriers often arise in industries with a higher degree of government regulations like commercial airlines, cable corporations, or the military sector. In most cases, the government establishes barriers to entry for public safety reasons. However, artificial obstacles created by the government often result in supporting the existing companies. The other reasons for creating barriers to entry are the lack of resources required by specific sectors or the protection of favored organizations in certain situations.

Thus, entry barriers are objective or subjective factors that prevent companies from organizing new production in the industry. In the following sections, we will review typical types and examples of barriers to entry.

Sales volume

One of the common barriers to entry is the large volume of sales of the existing players in the market. Sales volume as a barrier to entry includes the following factors: market saturation with goods, low paying capacity of the population, and presence of foreign competitors.

The maximum sales demand depends on the market size, regardless of whether one or more firms will supply this volume. The larger the market size, the lower the entry barrier and more market space for a greater number of companies. The smaller the market size, the fewer opportunities for potential competitors to enter it and find their product-market fit.

Market saturation with goods or services and the low paying capacity of customers make it difficult for new market entrants to compete with them. In addition, limited market and inability to find relevant niches for new products turn large sales volumes of competing companies into a severe obstacle to market entry.

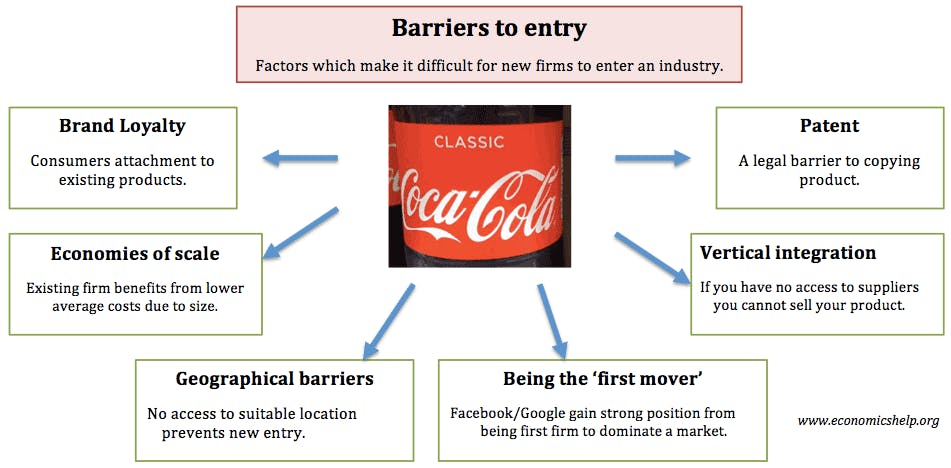

It is incredibly challenging to enter a market dominated by prestigious and well-known companies with large sales volumes. Prominent companies like Coca-Cola have high brand loyalty and large marketing budgets. To build their own brand loyalty, new market entrants would have to spend a lot of money on advertising. For this reason, Chinese automobile manufacturers often experience difficulties when trying to enter foreign markets.

Capital availability

When entering a market, companies often require a large amount of capital to build significant enough businesses. The investments include raw materials, construction, equipment, and sunk costs that can not be recovered. As the result, the capital turns into the entry barrier and restricts access to many industries in this case.

The young companies often underestimate the investments required to bring the first production unit to the market. Moreover, to expand business in the existing market, the companies may need an even larger volume of funds. The additional expenditures may include storage, compensations for defective goods, or promotional activities. Major market players can raise the necessary capital without considerable problems, and at lower interest rates, as well they can reinvest extra funds to expand their production or enter new markets.

The industries that require substantial investments in facilities, equipment, or R&D include steel production, manufacturing, space transport, and pharmaceuticals. For example, microchip producers like Intel create high barriers to entry due to the considerable cost of manufacturing equipment and R&D needed to keep the products technologically advanced.

Financial risk and market uncertainty

Market uncertainty creates an additional barrier to market entry. When a market participant needs to choose among several existing investment opportunities with similar benefits, there are always the opportunity cost and possible financial risks. Financial risks can arise from a range of external and internal factors, such as economic recessions, industry and legal changes, new competitors, inadequate cash flow management, or underperformance. The most common financial risks include credit, operational, liquidity, and market risks.

Credit risk is the financial loss that results from the company’s inability to comply with the terms of the financial agreement, such as failure to make regular payments on loans owed by the organization. Credit risks occur when the company makes investments in mergers, acquisitions, asset purchases, or finances other businesses through mortgages or varied types of credit.

Operational risk refers to the problems that can occur as a result of the company’s routine activities. These risks include lawsuits, ineffective business strategy, fraud, or lack of employee training.

Liquidity risk is related to the company’s ability to convert its assets into cash in the event of significant demand for the additional funds. Liquidity risk poses a danger to the company during periodic or general revenue declines when the company cannot fulfill the requirements and continue operating as a business.

Market risk often arises because of economic uncertainties and affects many companies. The risk results in a financial loss following market fluctuations, ineffective implementations of the go-to-market strategy, increases in raw material prices, or a rise in the interest rate. Changes in currency rates directly impact loan repayments and the competitiveness of the products and services compared to foreign analogs.

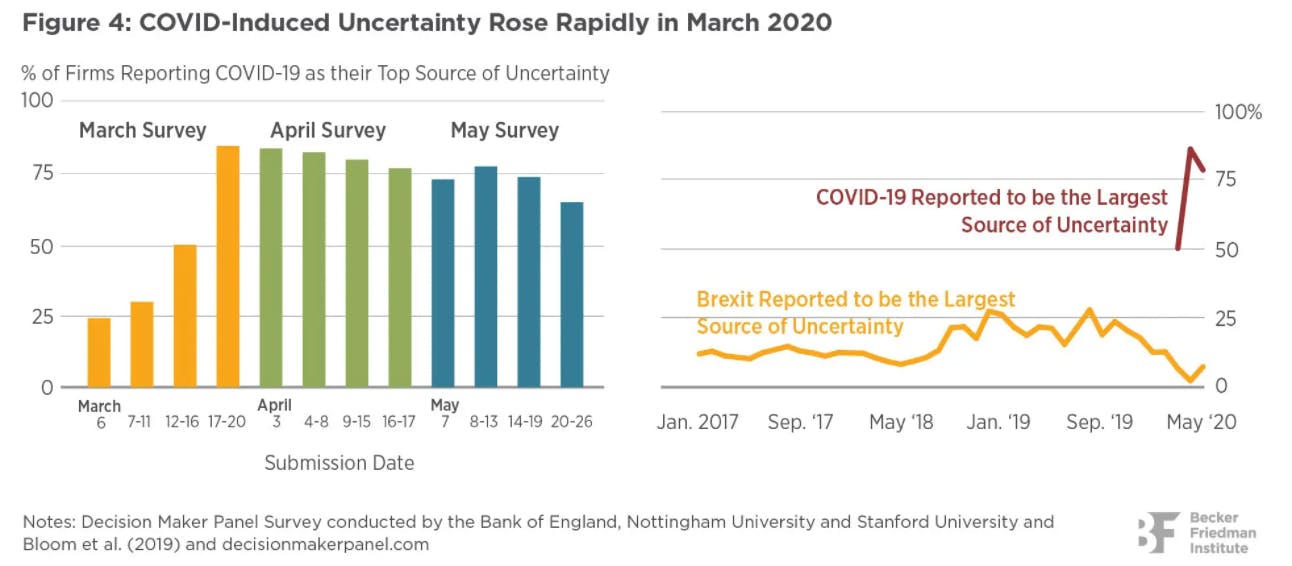

During the COVID-19 pandemic, traditional retail businesses faced extraordinary challenges. The market risk was caused by a growing tendency of people to make purchases online. Some companies have adapted their business processes to online shopping and experienced revenue growth. The other firms that failed to adapt to new conditions have incurred substantial losses.

In the early days of the coronavirus outbreak, the movie-theater industry experienced film delays, cinemas closures, and event cancellations. At the same time, streaming platforms became the only way for consumers to watch movies and TV shows. In 2020, Netflix added 26 million new subscribers and set a new record. Major film studios, including Disney, Warner Bros., and Universal, canceled film screenings in theaters and broadcasted them online instead.

The pandemic also had a great impact on education. Schools all over the world have been closed due to COVID-19. Since then, the education industry has undergone significant transformations that included the rise of e-learning, the development of digital educational platforms, and the increase in the use of video conferencing tools like Zoom and Slack. It is expected that by 2025, the overall market for online learning will reach $350 billion.

Product differentiation

The leading companies usually have a high level of brand awareness and customer loyalty. It creates the other barrier to entry for the startups that have to invest a considerable amount of money in marketing efforts. When bringing the new product to the market, young companies should clearly communicate benefits to the target audience and develop an effective positioning strategy. These activities require marketing resources that often exceed the companies’ capabilities.

If the newcomer employs a well-known brand name from the existing markets, the company will be able to mitigate the product differentiation obstacle. In some cases, the brand’s name in other industries may be more powerful than the names of the established brands in the market. For example, American Express is a household name through its operations in finance and a number of other industries, so it would be easier for the company to enter the new markets compared to the young companies. If you’d like to learn more about differentiation, you can read our article on differentiation strategy.

Cost advantage

Existing companies often have cost advantages that the potential newcomer will not be able to replicate. The cost advantages of incumbent companies arise due to the access to cheaper or better resources or by using their past innovations. Comparative advantage occurs when the company that already operates in the industry produces a larger volume of goods than a potential competitor can handle.

Cost advantages include access to raw material sources, cheaper labor and distribution channels, a learning curve or complex operations and demand training, cutting-edge technologies, patents, secret production methods, or favorable locations. The companies Alcoa and International Nickel have a cost advantage by having access to ore deposits. American Tobacco controls the supply of tobacco leaves, thus creating a barrier to entry for the new companies.

Cost of capital

Cost of capital is one of the most prevalent barriers to entry for new companies. To keep up with the competition, the new entrants should invest in the technology and equipment they use to manufacture the products, the premises they work in, and raw materials. But, unfortunately, capital expenses in some markets prevent all but a few potential new competitors from entering.

To establish a new telecommunications network, a young company will require billions of dollars of investments which dramatically reduces its chances to enter the market. However, startups can avoid the barrier by outsourcing parts of their processes to corporations with available resources.

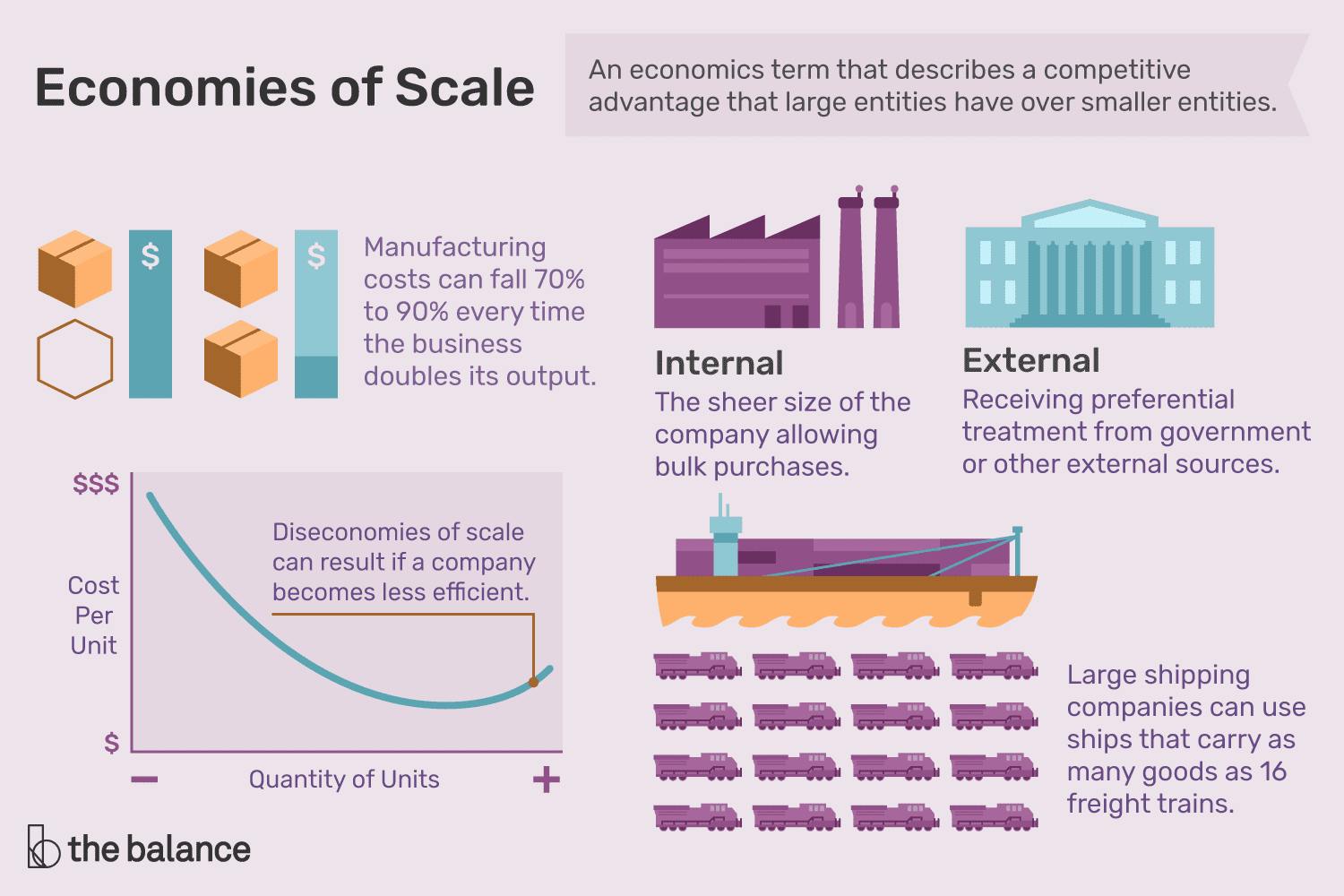

Economies of scale

Economies of scale create a barrier for new entrants as incumbent companies buy large amounts of raw materials and intermediary products at discounted prices. It results in the decline of the product’s unit cost and the increase of the total production volume per period. Thus, new players will be unable to produce the same product volume as their competitors when entering a market. Fixed production costs will make it impossible for new competitors to enter and overcome this stage.

Despite the challenges and disparity in scale, the application of advanced technologies, excellent customer service, and a well-designed marketing campaign will contribute to developing niche markets and brand promotion in the market. Nowadays, technological innovations can reduce the influence of economies of scale. For example, computing power is now accessible to practically all organizations. Half a century ago, in contrast, only the largest corporations could use this benefit.

The consumer electronics market is more vulnerable to economies of scale than other industries. Accordingly, the production scale often serves as an obstacle for small businesses. Established companies like Apple use specific strategies that prevent consumers from switching to other electronic devices and telecommunication companies. These approaches include the agreements with termination fees, software and data storage that cannot be moved to other gadgets, or the need to pay for applications for the second time when changing phone service suppliers.

Government regulation

Governments show great interest in specific market sectors and use various regulations such as licenses and patents to restrict or prohibit industry entry. The industries with strict standards, regulations, and licensing may develop considerable barriers to entry. The restrictions imposed by the authorities are either created by government-owned enterprises or used to protect the existing market players.

The new market participants will discover that the existing companies have already adapted their activities to meet regulatory requirements. In some situations, licensing and permit requirements may increase the costs required for market entry and establish the antitrust barrier to entry.

The government regulates individual industries by setting prices and managing the amount and quality of goods. Examples of such sectors are alcohol and pharmaceutical retailing. The other example is the telecommunication industry that experiences various regulatory obstacles, such as local content requirements or the purchase of spectrum licenses from the auction. However, some of these legislative barriers were lowered in recent years, particularly in Europe. For example, the European governments started to set wholesale spectrum and bandwidth tariffs for newcomers to encourage competition and cut customer prices.

Intellectual property and technological superiority

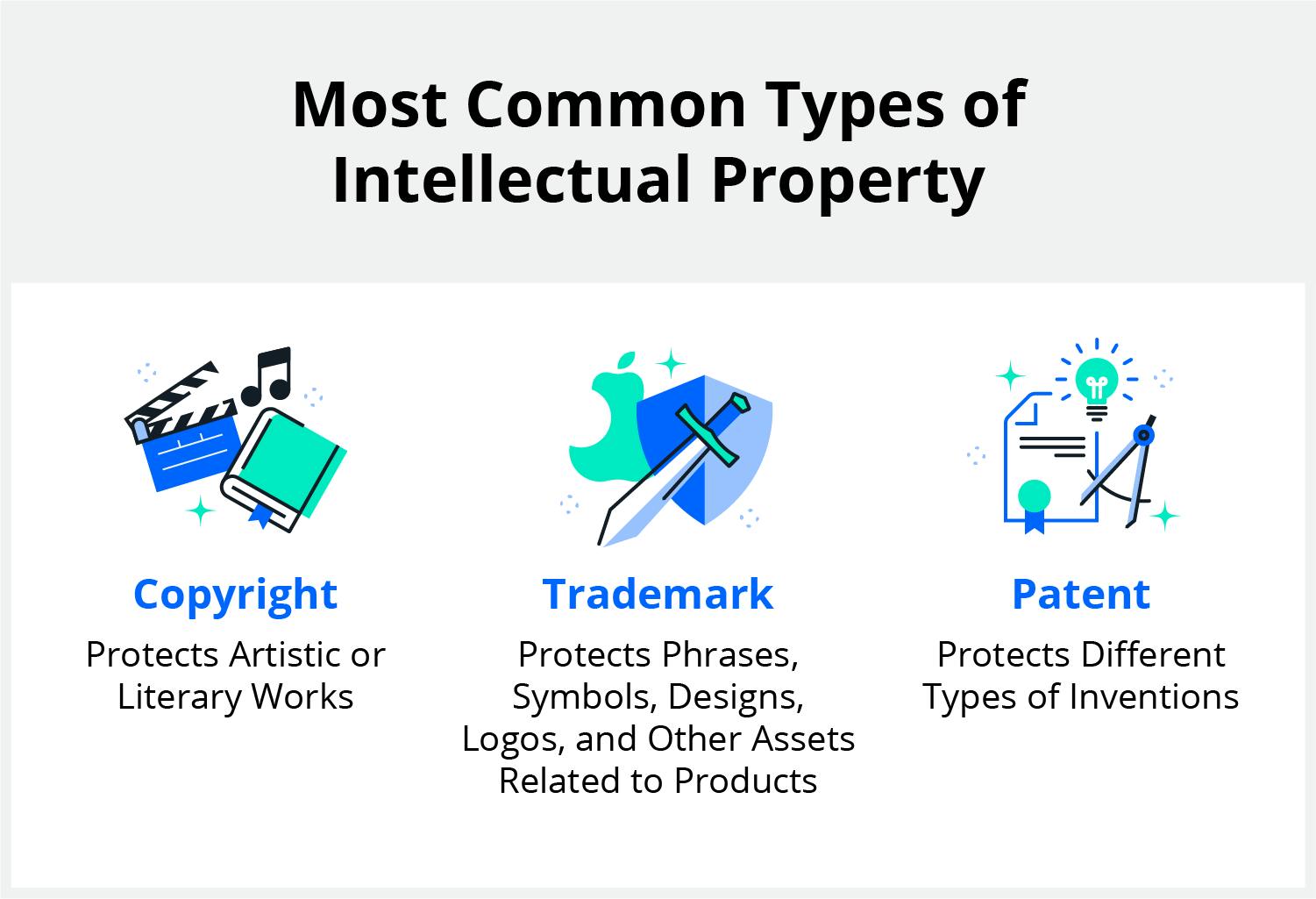

Another distinct group of entry barriers for young companies encompasses unique patents, trademarks, and other forms of intellectual property. The expertise in novel or rare technologies can also serve as the entry barrier. New entrants will not be able to produce goods or perform services in the same way as the patent owner until the document expires.

Patents are designed to foster innovation and prevent companies from developing, using, or selling products within a specific timeframe and, as a result, limit access to the market. The patent generates additional income for the incumbent companies that can be used for financing R&D and creating opportunities for the development of the other products. Other businesses may create and distribute the goods at equal or lower prices when the patent expires.

The pharmaceutical companies protect their products with legal patents to prevent competition and compensate for their R&D expenses incurred in the process of creating the drugs. As a result, other businesses cannot recreate the medicine, even if it would bring serious profits.

The existing semiconductor companies like AMD have invested enormous financial resources in patent development and advanced technology acquisition. To compete with the established companies, new entrants are compelled to purchase licenses for processes and technologies from existing firms.

Tesla has several competitive advantages over established automobile companies and potential new entrants. These advantages are brand name and technological superiority. In addition, Tesla has made notable investments in research and development and has established considerable expertise, creating a high barrier to entry for new competitors. Now the company’s key to success is its innovation strategy that focuses on the whole industry transformation and the development of environmental and energy regulations that the other automobile manufacturers cannot meet.

How to tackle barriers to entry?

It is always a challenge for small businesses to compete with large corporations. They often lack financial and human resources, which creates significant entry barriers. Further, we will consider the common strategies to tackle the obstacles and bring the product to the market.

Discover your consumer base and learn your customers’ preferences better than competitors. It may seem complicated, but you need to understand what motivates your target audience to make a purchase. Conduct market research to receive extensive feedback from potential clients through interviews, focus groups, or surveys. Then you will be able to develop ways to make your product more enticing than the competitors’ offers.

Use different pricing models. You need to set up a pricing model that will align with your overall product marketing strategy and distinguish the company from the competitors at the same time. For example, suppose you enter the market where the existing companies use the same pricing strategy, such as the subscription-based model. In that case, you can utilize one-time purchases, thus offering an alternative way to purchase the product or service.

Consider other investment opportunities. Choose a different market that is not affected by government restrictions or uncertainties. Develop and export alternative product lines that will not be vulnerable to barriers or regulations. If the situation in the target market is unstable, delay market entry and focus on different investment opportunities.

When the small business tries to bring the product to the new market, it is worth noting that high barriers to entry are not necessarily a bad sign. On the contrary, you will turn them into advantages, if you manage to tackle them. High barriers to entry increase the business’ attractiveness to the customers and protect the industry from competitors resulting in increased revenue and profits.