Financial services marketing: strategies and examples

Jan 11th, 2023

Contents

What is financial services marketing?

Marketing strategies for financial services

Examples of marketing the financial services

The financial sector is experiencing a shakeup due to the digital revolution, and the rules of the game have significantly changed. Tech-savvy customers have higher expectations from the financial services industry. However, your marketing opportunities are severely constrained by new regulatory and compliance barriers. The business won’t be able to succeed in this unstable environment by relying entirely on conventional and old-fashioned marketing techniques.

Today many banks provide online services. If financial institutions wish to stand out from the competition in the financial services industry, they must focus on providing outstanding user experience. To improve visibility and streamline processes, they should transition to digital technologies. In this article, we will examine the most practical digital marketing strategies used by financial services companies.

What is financial services marketing?

Financial services marketing is the process of promoting products and services of companies in the financial and banking sectors. The goal of financial services marketing is to generate awareness, attract prospects and turn them into devoted customers through a series of continuing marketing activities. Financial companies that may take advantage of financial services marketing include commercial banks, financial technology companies, financial advisory firms, credit unions, accounting companies, insurance companies, investment banks, and mutual funds.

Marketers in finance create content for specific target audiences, including individual customers, commercial businesses, healthcare facilities, and educational institutions. There are two main strategies for marketing financial services: digital marketing, which uses both inbound and outbound channels, such as blogs and PPC advertisements, and traditional marketing, which uses TV, radio, and print.

The majority of financial services firms combine traditional and digital marketing methods. Nevertheless, most companies rely on traditional advertising because of legacy practices. At the same time, digital marketing strategies are gaining popularity as they are proving to be effective methods of connecting with customers. For example, financial organizations can interact with potential customers directly through social media and provide online support. Furthermore, digital channels allow sales and marketing teams to create more personalized experiences tailored to each user’s preferences and demands and help facilitate customer loyalty.

What’s unique when marketing financial services?

Financial services marketing differs from other industries since it typically has more rules and restrictions, which are determined by the law, advertising standards, and various regulatory organizations. Thus, the majority of financial services companies rely on conventional and tried-and-true techniques and produce marketing materials that could be more inspiring and effective.

The other challenge marketers face in promoting financial companies’ products is commoditization. This term refers to the idea that products and services offered by one business are interchangeable with those provided by rival companies. Due to the standardization of financial products, companies encounter difficulties differentiating and marketing their offerings.

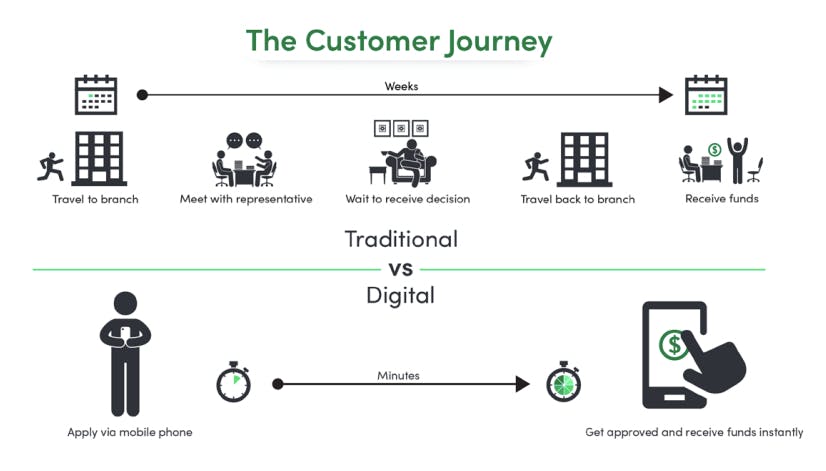

With the development of digital technologies, tech-savvy customers expect the same flawless digital experiences they face when using Google, Facebook, and Amazon. However, financial services providers frequently need more resources to implement such complex technologies. For this reason, it becomes difficult for traditional companies to compete with fintech startups that provide digital offerings. Moreover, thanks to digitization, marketers started using three or more channels in one campaign. As a result, traditional financial companies faced the shortage of budget needed to finance the omnichannel marketing initiatives.

In addition, a hypercompetitive environment and lack of consumer trust make it even more challenging for organizations to stand out from the crowd and reach the right audience. A survey by Mastercard revealed that only 55% of customers trust their banks, while 39% have a neutral opinion. Furthermore, consumer trust has been damaged by financial market changes over the last ten years after the 2008 Financial Crisis making it more challenging for financial services marketers to establish a genuine connection with the audience.

Despite these challenges, digital marketers can still find solutions to the mentioned problems. Further, we will describe the marketing strategies that will help change the competitive landscape in the financial services industry and ensure the company’s success in an unpredictable future.

Marketing strategies for financial services

Let us explore seven strategies for marketing financial services that will help you draw in more leads and convert them into loyal customers. We will consider website optimization, email marketing, social media marketing, and other approaches.

Website optimization

Although previous generations are more used to traditional marketing methods, digital natives like millennials and generation Z have different expectations. They want to minimize human interaction and conduct all their financial operations online. To meet the needs of digital natives, financial services companies should focus on website optimization and make their websites secure, user-friendly, optimized for search engines, and fast loading.

A financial services company’s website should have a responsive design and be speedy and intuitive. The design should not detract attention from the content. Customers visit your website to find information or perform a task, so its elements should be naturally organized and simplify the search process. You can add a built-in search function and include clear CTA buttons. To identify areas where users are having difficulties, use a tool like Hotjar or Microsoft Clarity to capture heatmaps and scrolling behavior.

Security is also crucial for the best user experience. One of the reasons why users abandon their carts is security concerns. Therefore, you need to use HTTPS protocol instead of HTTP. HTTPS protocol employs transport layer security, or TLS, to encrypt HTTP requests and secure data transfer. This protects customers’ private data when they sign into a bank account or enter a password.

Search engine optimization

SEO, or search engine optimization, is a marketing strategy that helps potential clients find your financial services company online and stand out among competitors. By choosing appropriate keywords for your website, customers will discover your website with one search, and you will make the website visible and bring in more organic traffic. Moreover, if you implement an effective SEO strategy, users will see your website on top of the page.

SEO strategy implies monitoring customer behavior, analyzing recent trends in the financial industry, and tracking competitors’ SEO activities. The first step to implementing the strategy is keyword research and optimization. Use tools like Ahrefs and Semrush to identify relevant keywords for your website and discover the ones used by your rivals. Then you need to update the title, meta descriptions, and alt tags to include keywords.

The next step is to make sure whether Google can index your website. The search engine has more than 200 ranking factors, so you need to do a sequence of actions to increase your website’s visibility in Google search results. Firstly, build a sitemap that navigates search engines around the website. Secondly, register your website on Google Search Console. It is a free tool that allows users to monitor their website’s performance in search results and identify any problems that might affect its functioning.

Lastly, you should consider domain authority. It is based on the website’s age, size, and popularity. If your website has existed for a long time, it has a large number of high-volume pages with excellent content and external links, and there are many high-quality backlinks to your website, you have a perfect starting point.

Content marketing

The other factor that significantly affects your website’s performance is unique, relevant, and quality content. Content marketing is a crucial component of your digital marketing strategy that builds trust and improves user experience. You can create various types of content, including blogs, social media publications, news stories, infographics, videos, case studies, and white papers.

The key to success is to generate valuable content that enhances customer engagement and leads to more comments and shares. Valuable content is publications that cause interest and educates your audience. For example, you can publish case studies or blog posts that provide solutions to your customers’ financial problems, tell success stories and describe how your products and services help solve consumers’ issues. When creating content, analyze it from the perspective of the average user unfamiliar with terms like fiscal period, income vs profit, APR vs interest rate, or other common banking terminology.

Use a conversational tone in your publications and messaging instead of authoritative. Although the financial industry has used a formal communication style for a long time to create the impression of professionalism, people are now tired of this. This is beginning to change as financial institutions use a more informal tone in their communications across all channels.

Email marketing

Email marketing is one of the most effective digital marketing tools. Once you optimize your website, you can start gathering contact details of your online leads and clients to stay in touch with them. It is an excellent way to personalize the customer experience. For this purpose, you can use tools like Automizy that can be integrated with your CRM or other databases. As a result, your banking email software will be synchronized with your client data, allowing you to send customized emails.

You can start with welcome emails and onboarding letters to create a great first impression about the company and attract new customers’ attention from the first emails. Then you can send your customers monthly or quarterly newsletters to keep them informed about the updates and provide an opportunity to look behind the scenes of your financial services company. You can offer special deals on life insurance or mortgages or announce new features or products through email. Use animated gifs, emojis, and simple copy in emails. Your email subscribers will be more engaged, and it will make learning about budgeting and saving less boring.

Social media marketing

Nowadays, consumers expect to see their favorite brands, including banks and financial institutions, on social media. Social networks are also a superb way to promote your content and redirect traffic to the website. By replying to comments and direct messages, you can interact with your audience, increase engagement, provide customer support and react to feedback in a positive and timely manner.

First, identify several social media platforms your target audience uses most often. A content plan should be customized for each social network. Leverage each platform's advantages while keeping your customer needs and preferences in mind. Then start sharing helpful content and telling stories that help humanize your brand. Having a personality and participating in genuine conversations with your audience can set you apart from the competition in a financial industry that many people find overly impersonal.

Involve social media influencers to build trust with your customers. You can also easily reach out to new audiences by choosing the right influencers to advertise your financial service. To attract millennials’ attention, you need to remember that only 16% of them are financially literate. Additionally, many people refrain from making investments due to a lack of knowledge. Therefore you can ask influencers to explain basic financial concepts in simple terms.

Video marketing

Some financial topics could be more complex or vast to cover in a single blog post or even an ebook. Instead, your financial organization might create educational webinars and videos. Make instructional videos to guide customers through processes like budgeting, taking out a loan, investing funds, and other topics.

Webinars are an effective way to build authority among your customers. Given that most consumers view financial institutions as impersonal, formal, and cold, the opportunity for financial companies to show a more human face through a webinar session is critical.

Webinars can help you generate leads, as this format offers more value than the majority of other marketing materials. If your webinar invitation captures prospects’ interest, they will sign up for it. Furthermore, conducting a webinar presents a fantastic chance to get to know your audience. This format encourages prospects to ask questions or raise concerns they otherwise wouldn't have done in a different setting or platform.

Run your webinar with key partners if you want more significant outcomes. It improves your relationships with businesses or influencers whose products or services complement your own and gives you a fantastic chance to market to new audiences. Collaborating with other financial services companies is a superb way to raise your brand equity.

PPC advertising

PPC advertising is one of the best ways to generate leads, rank more quickly for relevant keywords, attract immediate traffic and bring in highly targeted visitors. There are different types of paid ad campaigns: retargeting advertisements, search advertisements, display advertisements, and social media promotions.

Retargeting ads involve displaying advertisements to users who have already viewed your website. Search advertising shows up at the top of search results when somebody enters a query. Display ads are shown to customers while they are on related websites. Paid social media ads allow people to find your business on social media.

A PPC strategy is useful whether you employ search advertising, display advertising, retargeting, or all of the above. Use landing pages with a specific purpose. Make it apparent to your customers how using your financial services would benefit them. Conduct keyword research. Keep in mind that most prospective clients will use Google to search for solutions to their financial issues. By performing keyword research, you may focus on search intent and increase the visibility of your PPC advertising to your target market. Finally, establish a budget. Set clear objectives from the start to get the most value out of your advertising costs.

Once you are familiar with the most efficient financial services marketing strategies, you can start applying them in practice. So let's look at how other companies do it first.

Examples of marketing the financial services

We will provide three examples of financial services marketing that will help you understand how to develop a marketing strategy for your company.

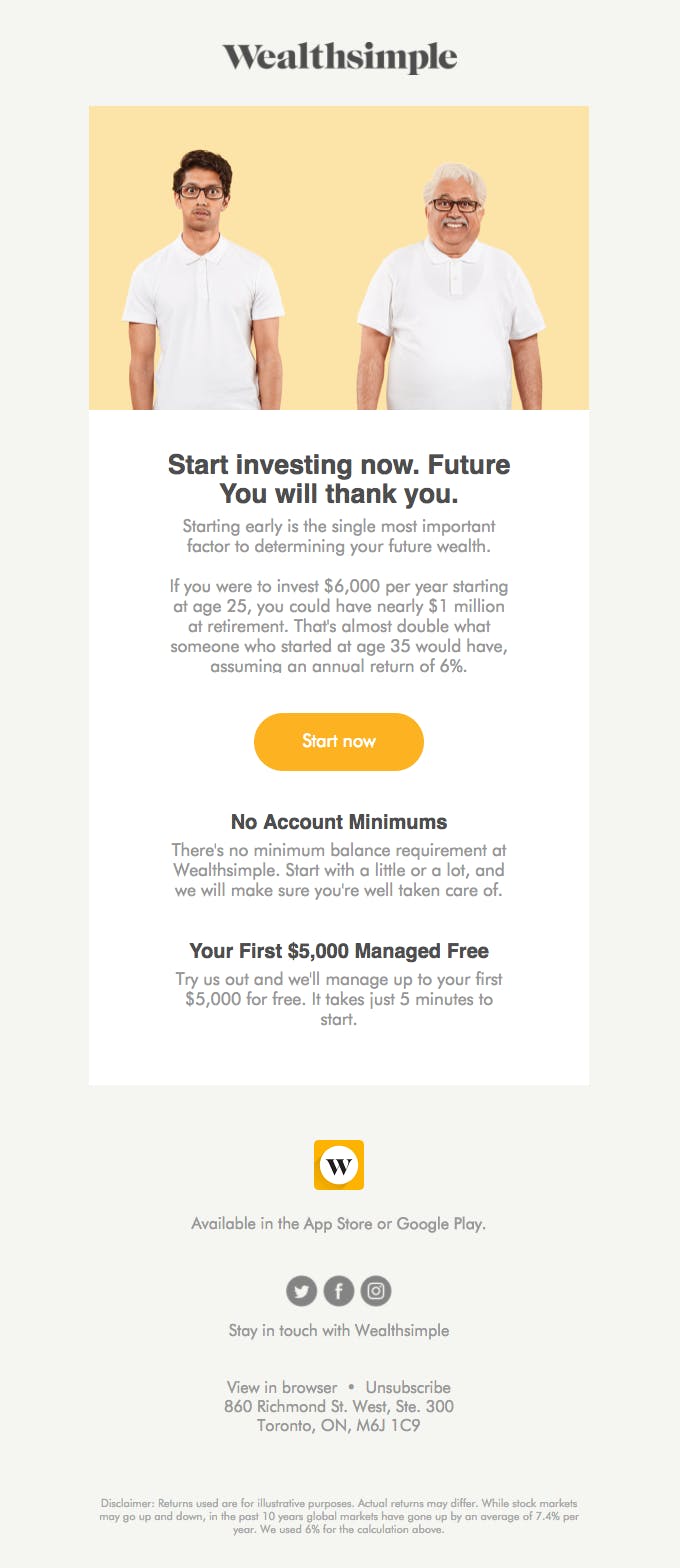

Wealthsimple, a Canadian online asset management platform, positions itself as a financial consultant. The company uses email to improve customer engagement, minimize churn rate, help customers understand the benefits of their products, and maximize the value of the efforts within their SaaS marketing. In addition, emails are a powerful method to upsell and increase revenue from existing clients.

TD Bank teaches customers about personal investments through webinars and how-to videos. To assist firms in managing transactions, they demonstrate professionals exchanging knowledge and tools. What is more, a company won the 2022 Content Marketing Award for creating TD Stories. This is a digital hub where TD bank provides financial tips and advice, describes cutting-edge technologies to create more personalized experiences, tells employees’ stories, and shares thought leadership from the company’s executives.

Prudential is one of the most well-known brands in financial services. The company employs a novel strategy for social media marketing, focusing on business clients on LinkedIn and connecting with them through various content formats. Prudential developed a "Thought Leader of the Week" campaign, which comprised interviews, white papers, and articles from senior staff members. This strategy helped the company establish its reputation as an industry thought leader and develop the individual brands of its staff members.

Whether customers contact you via your website or application, the best marketing strategy for financial services embraces a customer-centric mindset. The essential task is to understand the problems that bother consumers, how to solve them, and how to keep people satisfied. The trends and methods we discussed in this article will provide you with a guide for creating your own digital marketing strategy.